EAGLE FORD MINERALS FOR SALE

Royalties & Overrides

All Standard Disclaimers Apply & Seller Rights Retained

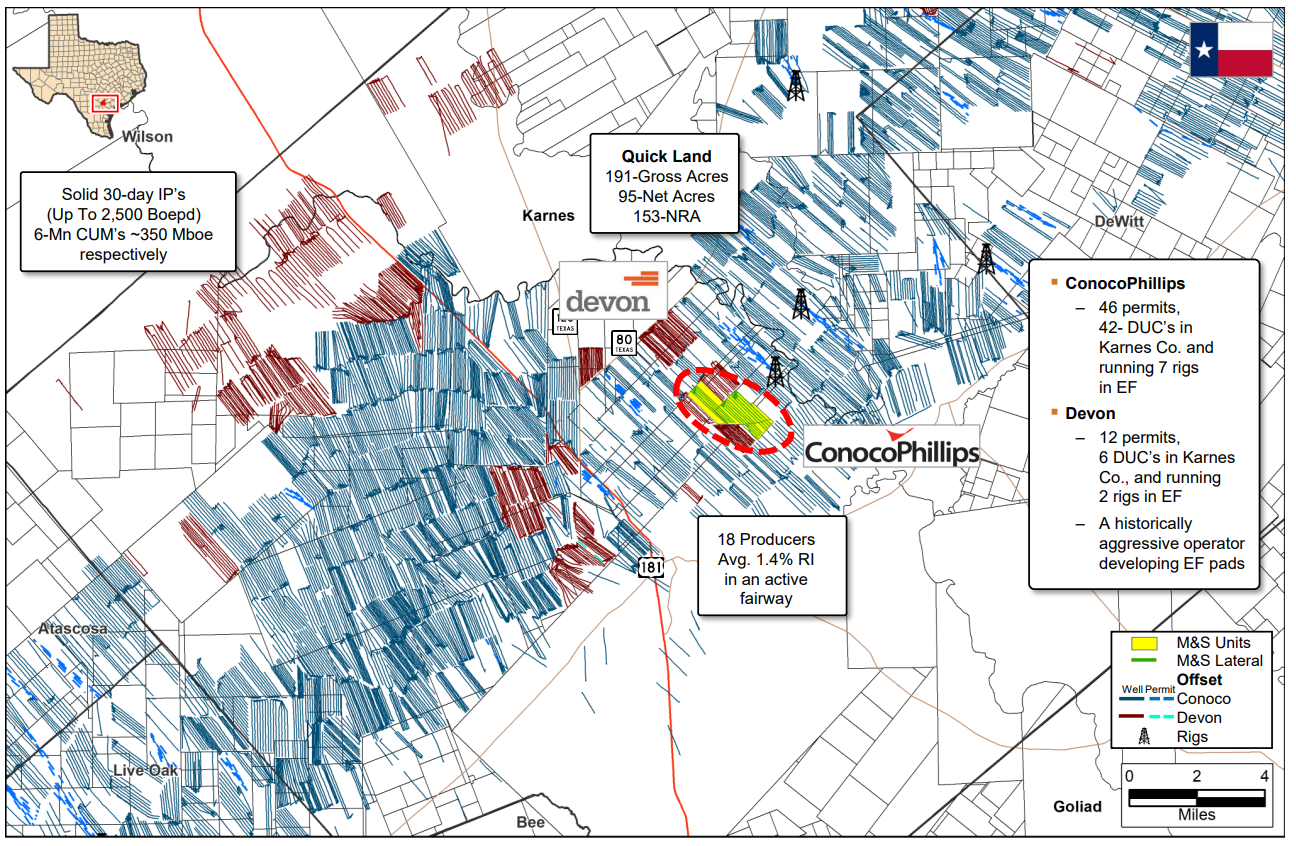

KARNES CO, TX ROYALTY

18-Wells; 5-Units. 95-NMA. 153-NRA.

EAGLEVILLE & SUGARKANE FIELDS

EAGLE FORD & AUSTIN CHALK

Highly Economic HZ Drilling Locations

Minerals In Core Condensate Window

Under Operators: Conoco & Devon

---COP/Devon Drilled 10 Wells In 2024

Average ~1.5% Royalty Interests For Sale

Gross Prod: 2,224 BOPD & 11,609 MCFD

Net Volumes: 45 BOED

Net Cash Flow: ~$95,000/Mo (L6M)

11-PUDs & 8-Additional Locations

OFFERS DUE ON OR BEFORE FEB. 26th

RR 7778DV

Energy Advisors Group is marketing the M&S Minerals portfolio in Karnes County, Texas—core Eagle Ford mineral and royalty interests operated by ConocoPhillips and Devon Energy.

The package consists of 18 producing wells delivering stable royalty cash flow with interests generally ranging from ~1–2%, supported by 11 proved undeveloped locations. Assets are contained in 6 units totaling 95 NMA and 153 NRA, offering both immediate income and long-term development upside.

Current production averages ~2,224 BOPD and 11,609 MCFPD gross, translating to ~24 BOPD and 127 MCFD net, with average net cash flow of ~$95,000 per month (L6M). The royalty-heavy structure provides a low-risk profile with direct exposure to future drilling activity.

Core Karnes Trough Mineral Package (95-NMA, 153-NRA)

Additional upside exists for up to 8 incremental locations under optimized spacing scenarios, subject to operator development plans. Continued horizontal development and recompletion activity in the area supports repeatable value creation.

Karnes County remains one of the most established and economic areas of the Eagle Ford, with stacked Lower and Upper Eagle Ford reservoirs and a long history of strong well performance. The assets benefit from existing infrastructure, condensate-weighted production, and best-in-class operators with demonstrated capital discipline.

Sale Package Highlights

- Core Eagle Ford mineral & royalty portfolio – Karnes County, TX

- 18 producing wells; Lower Eagle Ford & Austin Chalk

- Average ~1.5% royalty interests

- Net cash flow ~$95k/month (L6M)

- Operated by ConocoPhillips and Devon

- Upside from PUDs, infill potential, and recompletions

- Established infrastructure and proven development history

Potential purchasers are encouraged to review the Virtual Data Room. The Private VDR includes a complete diligence package with (1) a summary 8 tab QuickLook, (2) the seller's PHDWin database with summary reports, (3) land and legal documents and (4) check stubs. The confidential files are available for review and download upon execution of the DocuSign NDA.

At this stage, the process remains negotiated with no formal bid date. If we do not receive an inbound expression of interest the seller is willing to accept over the next few weeks, we anticipate setting a bid date for mid to late February / early March.

Also worth noting — the sellers are open to flexibility on transaction structure. They would consider either an all-cash “one-shot” offer or a structured solution that pays out over time, provided overall terms are attractive and creditable.

TO LEARN MORE:

Richard Martin

Director – Special Projects & Execution

Phone: (469)-866-9796

Email: rmartin@energyadvisors.com

Energy Advisors Group

4265 San Felipe Street, Suite 650

Houston, TX 77027

Phone: (713) 600-0123

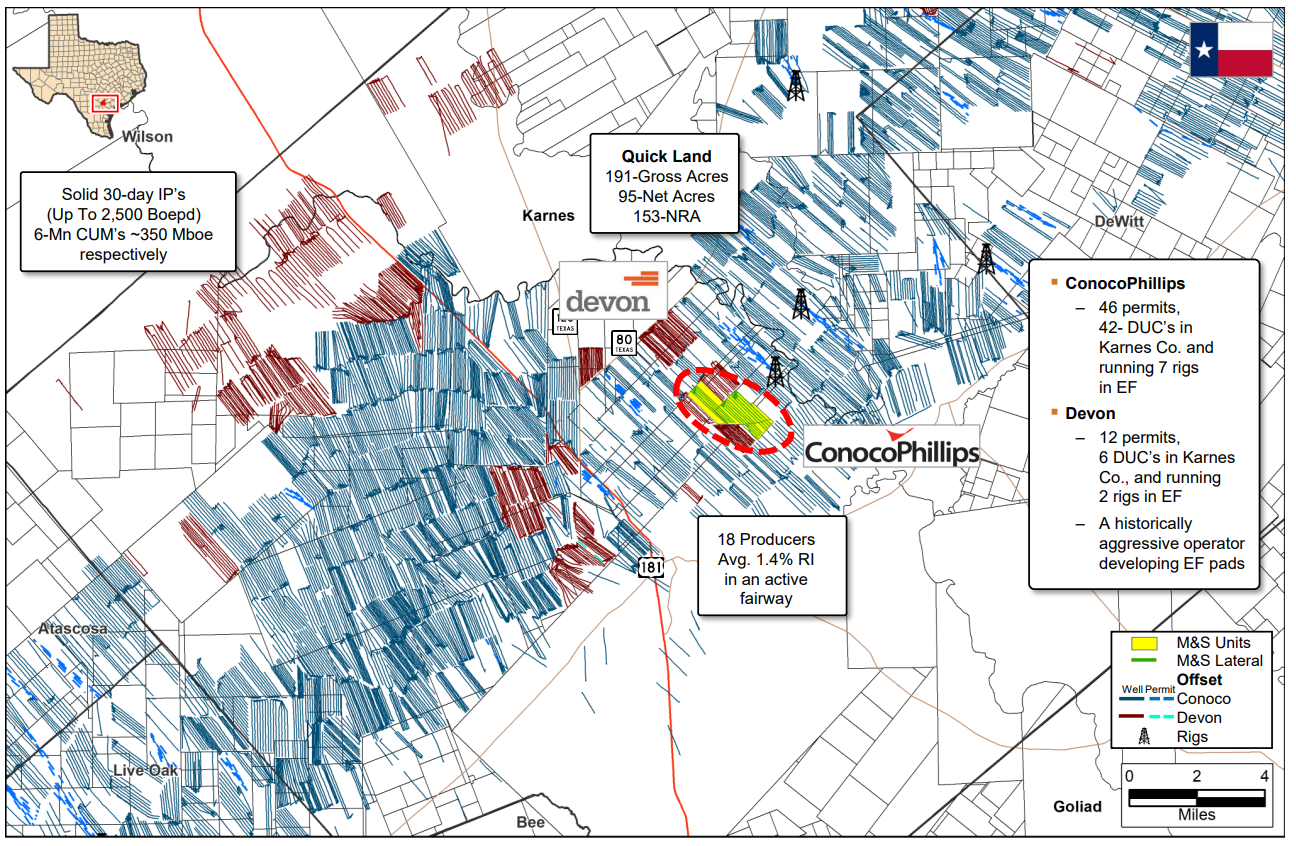

KARNES CO, TX ROYALTY

18-Wells; 5-Units. 95-NMA. 153-NRA.

EAGLEVILLE & SUGARKANE FIELDS

EAGLE FORD & AUSTIN CHALK

Highly Economic HZ Drilling Locations

Minerals In Core Condensate Window

Under Operators: Conoco & Devon

---COP/Devon Drilled 10 Wells In 2024

Average ~1.5% Royalty Interests For Sale

Gross Prod: 2,224 BOPD & 11,609 MCFD

Net Volumes: 45 BOED

Net Cash Flow: ~$95,000/Mo (L6M)

11-PUDs & 8-Additional Locations

OFFERS DUE ON OR BEFORE FEB. 26th

RR 7778DV

Energy Advisors Group is marketing the M&S Minerals portfolio in Karnes County, Texas—core Eagle Ford mineral and royalty interests operated by ConocoPhillips and Devon Energy.

The package consists of 18 producing wells delivering stable royalty cash flow with interests generally ranging from ~1–2%, supported by 11 proved undeveloped locations. Assets are contained in 6 units totaling 95 NMA and 153 NRA, offering both immediate income and long-term development upside.

Current production averages ~2,224 BOPD and 11,609 MCFPD gross, translating to ~24 BOPD and 127 MCFD net, with average net cash flow of ~$95,000 per month (L6M). The royalty-heavy structure provides a low-risk profile with direct exposure to future drilling activity.

Core Karnes Trough Mineral Package (95-NMA, 153-NRA)

Additional upside exists for up to 8 incremental locations under optimized spacing scenarios, subject to operator development plans. Continued horizontal development and recompletion activity in the area supports repeatable value creation.

Karnes County remains one of the most established and economic areas of the Eagle Ford, with stacked Lower and Upper Eagle Ford reservoirs and a long history of strong well performance. The assets benefit from existing infrastructure, condensate-weighted production, and best-in-class operators with demonstrated capital discipline.

Sale Package Highlights

- Core Eagle Ford mineral & royalty portfolio – Karnes County, TX

- 18 producing wells; Lower Eagle Ford & Austin Chalk

- Average ~1.5% royalty interests

- Net cash flow ~$95k/month (L6M)

- Operated by ConocoPhillips and Devon

- Upside from PUDs, infill potential, and recompletions

- Established infrastructure and proven development history

Potential purchasers are encouraged to review the Virtual Data Room. The Private VDR includes a complete diligence package with (1) a summary 8 tab QuickLook, (2) the seller's PHDWin database with summary reports, (3) land and legal documents and (4) check stubs. The confidential files are available for review and download upon execution of the DocuSign NDA.

At this stage, the process remains negotiated with no formal bid date. If we do not receive an inbound expression of interest the seller is willing to accept over the next few weeks, we anticipate setting a bid date for mid to late February / early March.

Also worth noting — the sellers are open to flexibility on transaction structure. They would consider either an all-cash “one-shot” offer or a structured solution that pays out over time, provided overall terms are attractive and creditable.

TO LEARN MORE:

Richard Martin

Director – Special Projects & Execution

Phone: (469)-866-9796

Email: rmartin@energyadvisors.com

Energy Advisors Group

4265 San Felipe Street, Suite 650

Houston, TX 77027

Phone: (713) 600-0123